GMoney Loans

If you need to go for an emergency medical treatment and are struggling to arrange cash, GMoney offers an advance against your mediclaim policy. Get instant medical financing without any collateral, repay in no-cost EMIs, with flexible tenure.

Quick Approval

Minimum Documents

Benefits of taking Medical Loan with GMoney

The GMoney medical loan is offered at 0% interest – No Cost EMI.

All treatments and surgeries are covered. View popular treatments.

GMoney has its network across 9592+ hospitals in the country.

GMoney offers a loan repayment period of 3 to 18 months.

GMoney doesn't ask for any collateral against the medical loan.

There is no interest or penalty if the loan is paid off

early.

Take out a loan that you will be able to repay easily. Your monthly outgoing for all of your loans combined should not exceed 50% of your monthly income.

GMoney offers a loan repayment tenure of 3 to 18 months. The longer the term, the lower the EMI but a standard advice is to go for shorter tenures.

Missing an EMI or delaying a payment are two major factors that can harm your credit score and make it difficult to obtain a loan in future.

The repayment procedure may have a significant impact on your finances and it’s crucial to tell your family in order to avoid setbacks.

GMoney understands a medical emergency and offers a very simple process to apply. Give a missed call on 7400 177 177 or Text “Hi” on WhatsApp to +91 96156 95156. You will receive a message with a link where you have to share your basic details and get an instant limit for your medical treatment. Click here to get your GMoney Health Card & know your medical loan limit.

STEP 1

Text “Hi” on WhatsApp to +9196156 95156 for GMoney Health Benefit Card application.

STEP 2

After completing all the steps, download GMoney App and activate your card.

STEP 3

Post limit approval, Hospitals in GMoney network can initiate the transaction and the requested loan amount gets transferred to them for your treatment.

For Customers / Patients : 022 4936 1515

Have questions? Ask us

For Customers / Patients :

Have questions? Ask us

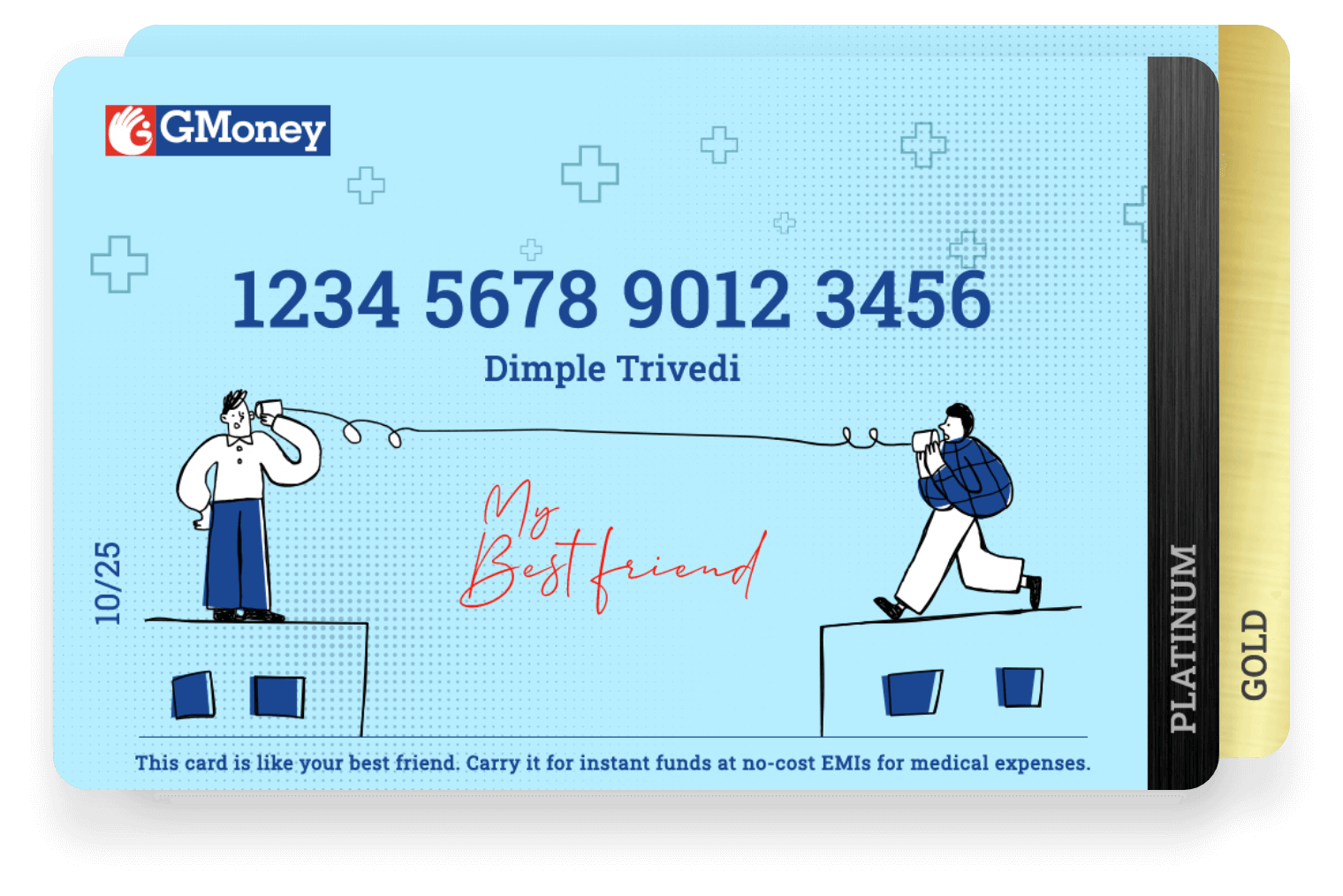

Digital Card for Everyone

Instant Activation

Pre-approved credit limit (on Gold / Platinum cards)

PAN Card

PAN card is required for all financial transactions in India and acts as an identity proof.

Aadhar Card

Aadhar card increases the credibility of the borrower to apply for health card.

Bank Statement (if required)

To activate your pre-approved credit limit on your GMoney health card, you will need to upload your bank statement.

Why GMoney

GMoney provides healthcare financial services across all types of treatments and surgeries in India. We offer medical loans at No Cost EMI and advance against medical policy.

Hospitals / Health Partners

Cities Covered Across India

Medical Treatments Included

Our Operational Cities

We know you have questions?

A medical loan is one kind of personal loan that provides financial coverage against medical expenses that a patient might have to incur during medical emergencies.

Apply for a medical loan from a healthcare financial service provider. You will be asked to submit documents & depending on your credit score, your application will be approved. Get treated first and pay later.

GMoney is a good choice for Medical Emergency Loans because of its simple application procedure, limit issue in less than 1 minute, loan approval within 10 minutes, maximum flexibility and quicker reception of funds.

You can never predict the exact amount of medical treatments and surgeries. So to have funds at disposal when such a time arises, medical loans come to the rescue.

Yes, you can get a loan. For that, you need to have a good credit score or a regular income to establish your credibility.

Yes, you can apply for a medical surgery loan. For that, you need to have a good credit score or a regular income to establish your repayibility.

Medical loans application is usually a simple procedure. At GMoney, the loan application is approved within 10 minutes and has maximum flexibility with quicker availability of funds.

Anybody with a good credit score or a regular income can apply for a medical loan

At GMoney, our documentation for a medical loan is kept at a bare minimum. For approval, we only need your PAN number. Once your application is approved, you need to submit your KYC details:

– Aadhar / Address proof

– Bank statements of the last 3 months

To know more, please contact us on 022 4936 1515

You can apply for a No Cost EMI at GMoney. It is kind of a medical loan without any interest. Get treatment first and pay later in instalments without paying any additional interest.

Give a missed call from your number on 7400 177 177 or Text “Hi” on WhatsApp to +91 96156 95156

Medical Loan Guide

Read our blogs

Testimonials

We're so blessed to have such a great feedback from our users. Here's what some of them are saying about us :

Treatments covered under

GMoney Medical Loan

Dental

Follow us

Reach us

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Quick Links

Bengaluru

GMoney Technologies Pvt. Ltd.

Oyo Work Spaces, Umiya Emporium,

Opposite Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka 560029

Ph : +91 89717 34815

Delhi

GMoney Technologies Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Next to jhandewalan metro station

gate no. 2 Barakhambha Road,

New Delhi, Delhi 110001

Ph : +91 97116 26832

Pune

GMoney Technologies Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Off, Airport Rd,

opposite Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra 411006

Ph : +91 84250 28758

Chandigarh

GMoney Technologies Pvt. Ltd.

SCO no. 292,

First Floor, Sector 35D,

Chandigarh

Ph : +91 84279 82012

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur – 302019

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad – 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) – 500081

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari, Tirumurthy Nagar, Nungambakkam, Chennai, Tamil

Nadu – 600 034

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Bengaluru

GMoney Pvt. Ltd.

3rd floor, Ranka Junction,

AH45, Krishna Reddy Industrial Estate,

Dooravani Nagar,

Bengaluru Karnataka - 560016

Ph : +91 72089 60444

Pune

GMoney Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Airport Rd,

Opp. Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra - 411006

Ph : +91 72089 60444

Delhi

GMoney Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Gate no. 2 Barakhambha Road,

New Delhi, Delhi - 110001

Ph :

+91 72089 60444

Chandigarh

GMoney Pvt. Ltd.

SCO No. 292,

First Floor, Sector 35D,

Chandigarh - 160022

Ph : +91 72089 60444

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) - 500081

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur - 302019

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari,

Tirumurthy Nagar,Nungambakkam, Chennai,

Tamil

Nadu - 600 034

Pune | Mumbai | New Delhi | Kolkata | Chennai | Navi Mumbai| Bengaluru | Ahmedabad | Nagpur | Hyderabad | Jaipur | Lucknow | Bhopal | Bhubaneswar | Nashik | Indore | Ghaziabad | Kanpur | Amritsar | Vasai | Noida | Gurugram | Chandigarh | Ranchi | Cuttack | Thane | Kalyan | Jalandhar | Kolhapur | Visakhapatnam | Chakan| Greater Noida | Wagholi | Raipur | Panvel | Belgaum | Mohali | Bhiwandi | Talegaon | Coimbatore | Palghar | Mumbra | Sangli | Surat | Durgapur | Ludhiana | Kochi | Agra | Ahmednagar | Ajmer | Akola | Aurangabad | Baroda | Beed | Rewari | Patiala | Vellore | Ranjangaon | Nanded | Nellore | Panipat | Panjim | Madurai | Mysore | Mangalore | Korba | Mathura | Kalaburagi | Jalgaon | Kharar | Guwahati | Kollam | Jamshedpur | Gwalior | Saswad | Solapur | Varanasi | Salem | Sambalpur | Jodhpur | Hubli | Panchkula | Faridabad | Amravati | Ayodhya | Badlapur | Dehradun | Parbhani | Ujjain | Udaipur | Tiruchirappalli | Srinagar | Shimla | Secunderabad | Ratnagiri | Pandharpur | Ananthapuram | Buldhana | Hadapsar | Baramati | Chittoor | Darjeeling | Dhule | Fatehpur | Gandhinagar | Haridwar | Gorakhpur | Jhansi | Kanchipuram | Kartarpur | Kurukshetra | Pondicherry | Prayagraj | Bharuch | Bhusawal | Bathinda | Pathankot | Nandurbar | Niphad | Kolar | Ambala | Kota | Pendurthi | Jabalpur | Palwal | Bhilai | Bhiwani | Bilaspur | Patna | Rohtak | Phagwara | Malegaon | Vijayawada | Bikaner | Chiplun | Darbhanga | Roorkee | Bhor | Rajahmundry | Margao | Alwar | Dhanbad | Bulandshahr | Aluva | Mulshi | Davanagere | Kapurthala | Anantapur | Loni | Latur | Gondia | Chhindwara | Chandrapur | Dharmapuri-TN | Faridkot | Dharwad | Daund | Chaksu | Bareilly | Kakinada | Haldwani | Doddaballapur | Dindori-MH | Bagru | Kudus | Kozhikode | Gurdaspur | Bokaro | Berhampur | Batala | Barrackpore | Ramgarh | Meerut | Bassi | Dera Bassi | Howrah | Karjat Raigarh | Thiruvananthapuram | Bheemunipatnam | Ambegoan | Allahabad | Aligarh | Alappuzha | Tirupathi | Thoppumpady | Srikakulam | Siliguri | Rourkela | Mirzapur | Gadag | Bellary | Tumkur | Sonipat | Hoshangabad | Junnar | Jalna | Hisar | Karnal | Kottayam | Muzzafarnagar | Ramnagara | Thrissur | Bahadurgarh | Balasore | Baraut | Dhar | Ernakulam | Gadhinglaj | Chikodi | Vaniyambadi | Kamothe |

Apply for GMoney Health Card