Home » The Role of Interest-Free Medical Loans in Affordable eye Care

When it comes to prioritising one’s health, financial constraints should never be a barrier to receiving essential medical care. This is especially true in the field of ophthalmology care, where timely treatment can make a significant impact on one’s vision and overall quality of life.

In recent years, interest-free medical loans have emerged as a viable option for patients seeking affordable access to ophthalmology services. These loans not only help increase access to essential eye care but also play a crucial role in enhancing patient outcomes and financial well-being.

Interest-free medical loans have emerged as a beacon of hope for many seeking ophthalmology care, offering a financial bridge to high-quality eye treatments. This financing model is tailored to eliminate the burden of interest, making it an attractive option for patients needing various ophthalmic treatments, , from routine eye exams to more complex surgeries like cataract removal or vision correction procedures. Provided by a wide range of healthcare centres and financial institutions, these loans democratize access to essential care by breaking down the total cost into manageable, monthly EMIs.

This innovative and convenient financial tool is designed with patient empowerment in mind. By removing the interest component traditionally associated with loans, it strips away the additional financial weight that can deter individuals from pursuing necessary medical attention. Consequently, patients are more inclined to schedule timely appointments and follow through with recommended treatments, ensuring that financial constraints do not stand in the way of maintaining or improving vision health.

Moreover, the process of securing an interest-free medical loan is often streamlined, with healthcare providers guiding patients through the application stages, mostly digitial and quick. This collaborative approach not only simplifies the financial aspect of eye care but also fosters a supportive environment where patients feel valued and cared for.

As these loans cover an extensive array of services, they are a versatile solution for patients across different economic backgrounds, making premium ophthalmology services reachable for a broader audience across Indian cities.

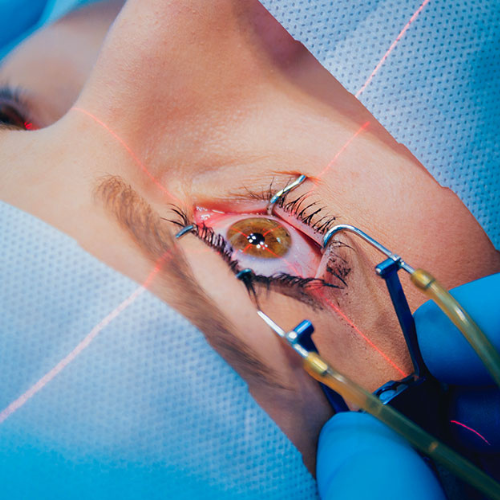

The introduction of interest-free medical loans in the realm of ophthalmology has been a ground breaking development in expanding access to vital eye care services. For a significant number of people, the immediate cost associated with advanced eye care treatments, such as laser-assisted in situ keratomileusis (LASIK) or intricate cataract surgeries, acts as a formidable barrier.

This financial obstacle often leads to the delay or complete avoidance of necessary medical interventions, putting patients at risk of deteriorating vision health. Interest-free medical loans mitigate this issue by enabling individuals to distribute the expense of their medical care over a period, thereby reducing the upfront financial burden.

This innovative No Cost EMI @ 0% interest financing approach of GMoney has notably broadened the spectrum of patients able to afford and access high-quality ophthalmology care. By removing the deterrent of large, lump-sum payments, more patients find themselves in a position to seek out and receive the care they need without the added stress of immediate, out-of-pocket expenditures.

The availability of such financial solutions empowers patients to make health decisions based on necessity rather than cost, ensuring that essential treatments are not delayed for economic reasons. Furthermore, the adaptability of interest-free medical loans to cover a wide range of ophthalmic services from basic eye examinations to more complex surgical interventions significantly contributes to the democratization of eye care.

This expanded access is instrumental in the early detection and treatment of eye conditions, reinforcing the importance of financial tools that support health equity and promote the well-being of diverse populations across India.

Interest-free medical loans introduce a novel way for patients to manage the costs associated with eye care without the added pressure of accumulating interest. This approach is particularly beneficial as it helps individuals navigate their healthcare needs without the looming worry of how these expenses will affect their financial future.

The absence of interest rates means that patients can focus on their immediate health concerns, securing necessary treatments without the burden of increased debt. This is a significant advantage, allowing for a more straightforward repayment process and diminishing the anxiety that often accompanies financial decision-making in healthcare.

The structure of these loans is designed to align with the patient’s ability to pay, offering a compassionate alternative to traditional financing methods. By sidestepping the pitfalls of interest-bearing loans, patients find themselves in a more secure financial position, not only in the short term but also looking ahead. This security can lead to a more proactive approach to eye health, as financial barriers are lowered, and access to care is prioritized.

Equally important, the availability of interest-free options can foster a sense of empowerment among patients. With financial constraints addressed, individuals are more likely to engage with their healthcare providers in making informed decisions about their ophthalmology care. This empowerment contributes to a healthier population, where financial wellness and physical health go hand in hand, underscoring the transformative potential of interest-free medical loans in the realm of patient finance.

In the realm of ophthalmology, the timing of treatment is often as critical as the treatment itself. Conditions such as glaucoma, macular degeneration, and diabetic retinopathy, if not addressed promptly, can lead to irreversible damage and even loss of sight. Interest-free medical loans serve as a pivotal tool in removing financial hindrances that may delay the pursuit of necessary care. By providing patients with the means to afford immediate treatment, these loans ensure that financial limitations do not translate into missed opportunities for preserving vision.

The structure of interest-free medical loans is such that it accommodates the urgency of medical interventions, offering quick disbursements that align with the treatment schedule. This swift response is indispensable in ophthalmology, where delays can exacerbate conditions, complicating what might have been straightforward treatments. For instance, early-stage cataract surgery is relatively simple and has a high success rate, but postponement can lead to the cataract becoming hypermature, necessitating a more complex surgical approach.

Furthermore, the assurance of having financial support encourages patients to adhere to follow-up care and necessary procedures without hesitation, fostering a continuous care model that is essential for optimal outcomes. This ongoing engagement with healthcare providers ensures that patients receive comprehensive care, from diagnosis to post-treatment follow-up, enhancing the overall effectiveness of the treatment received.

By mitigating the delay in accessing critical care, interest-free medical loans have a direct and profound impact on patient outcomes in ophthalmology. They not only facilitate the timely initiation of treatment but also support sustained patient engagement in preventative care and management, pivotal for long-term ocular health.

Navigating the landscape of interest-free medical loans requires careful consideration. Before embarking on this financial journey, it’s crucial for patients to thoroughly understand the specifics of their loan agreement. This includes being cognizant of any hidden fees, such as administrative costs or penalties associated with missed payments, which could unexpectedly inflate the overall financial obligation. The allure of zero interest can sometimes overshadow these additional charges, making it imperative that patients scrutinize the fine print.

Equally important is a patient’s self-assessment of their financial health. Engaging in a loan, even one without interest, commits an individual to a structured repayment plan. It demands a realistic evaluation of one’s current and foreseeable financial situation to avoid future strains on their budget. This assessment should not be taken lightly, as defaulting on loan payments can lead to financial stress and potentially impact one’s CIBIL / credit score, hindering future borrowing capabilities.

Moreover, the financial solution presented by interest-free loans should not deter patients from exploring other viable alternatives. Many institutions offer a variety of financing options that might better suit an individual’s circumstances. It is advisable for patients to conduct a comparative analysis of available financial aids, weighing the benefits and drawbacks of each to determine the most advantageous arrangement for their unique needs.

In essence, while 0% interest medical loans are a valuable resource in accessing necessary ophthalmology care, they come with their own set of considerations that require diligent attention and responsible financial planning.

As we look ahead, the landscape of financing options for ophthalmology care is set to evolve, driven by a combination of technological advancements and a deeper understanding of patient financial needs. Interest-free medical loans are paving the way for a more inclusive approach to healthcare financing, potentially inspiring a wider array of tailored, patient-friendly payment solutions.

The innovation doesn’t stop here; the integration of digital platforms could streamline the application and management processes, making it even more convenient for patients to access the financial support they need for their eye care. In addition, as awareness grows about the benefits of such financial models, we might witness an expansion in the number of providers offering interest-free options, increasing competition and possibly leading to even better terms for patients. This forward momentum represents a significant shift towards ensuring that ophthalmology care is within reach for everyone, regardless of their financial situation, marking a step forward in healthcare equity and accessibility.

About GMoney

At GMoney, we are dedicated to removing financial barriers to healthcare, ensuring that every individual has access to the care they need when they need it. We specialize in making dental treatments more affordable with our no-cost, interest-free EMI options, enabling patients to maintain their oral health without the stress of upfront costs.

In an exciting collaboration with the Indian Dental Association, we are empowering dentists across the nation to offer our innovative and convenient payment solutions. This partnership ensures that more patients can access a wide range of dental services—from routine check-ups to advanced procedures—without financial hesitation.

Our network includes highly respected dental professionals committed to providing exceptional care. With GMoney, patients can receive immediate treatment with the assurance that the costs can be managed comfortably over time. Our quick approval process and straightforward financing options are designed to bring peace of mind to your dental visits.

For more information on how GMoney can help you manage the cost of dental care, visit our website or speak to your dentist about our no-cost EMI plans. Together with the Indian Dental Association, we are making dental health a priority for everyone.

Follow us

Reach us

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Quick Links

Bengaluru

GMoney Technologies Pvt. Ltd.

Oyo Work Spaces, Umiya Emporium,

Opposite Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka 560029

Ph : +91 89717 34815

Delhi

GMoney Technologies Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Next to jhandewalan metro station

gate no. 2 Barakhambha Road,

New Delhi, Delhi 110001

Ph : +91 97116 26832

Pune

GMoney Technologies Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Off, Airport Rd,

opposite Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra 411006

Ph : +91 84250 28758

Chandigarh

GMoney Technologies Pvt. Ltd.

SCO no. 292,

First Floor, Sector 35D,

Chandigarh

Ph : +91 84279 82012

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur – 302019

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad – 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) – 500081

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari, Tirumurthy Nagar, Nungambakkam, Chennai, Tamil

Nadu – 600 034

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Bengaluru

GMoney Pvt. Ltd.

Oyo Work Spaces,

Umiya Emporium,

Opp. Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka - 560029

Ph : +91 89717 34815

Pune

GMoney Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Airport Rd,

Opp. Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra - 411006

Ph : +91 84250 28758

Delhi

GMoney Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Gate no. 2 Barakhambha Road,

New Delhi, Delhi - 110001

Ph : +91 97116 26832,

+91 80769 00775

Chandigarh

GMoney Pvt. Ltd.

SCO No. 292,

First Floor, Sector 35D,

Chandigarh - 160022

Ph : +91 84279 82012

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad - 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) - 500081

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur - 302019

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari,

Tirumurthy Nagar,Nungambakkam, Chennai,

Tamil

Nadu - 600 034

Pune | Mumbai | New Delhi | Kolkata | Chennai | Navi Mumbai| Bengaluru | Ahmedabad | Nagpur | Hyderabad | Jaipur | Lucknow | Bhopal | Bhubaneswar | Nashik | Indore | Ghaziabad | Kanpur | Amritsar | Vasai | Noida | Gurugram | Chandigarh | Ranchi | Cuttack | Thane | Kalyan | Jalandhar | Kolhapur | Visakhapatnam | Chakan| Greater Noida | Wagholi | Raipur | Panvel | Belgaum | Mohali | Bhiwandi | Talegaon | Coimbatore | Palghar | Mumbra | Sangli | Surat | Durgapur | Ludhiana | Kochi | Agra | Ahmednagar | Ajmer | Akola | Aurangabad | Baroda | Beed | Rewari | Patiala | Vellore | Ranjangaon | Nanded | Nellore | Panipat | Panjim | Madurai | Mysore | Mangalore | Korba | Mathura | Kalaburagi | Jalgaon | Kharar | Guwahati | Kollam | Jamshedpur | Gwalior | Saswad | Solapur | Varanasi | Salem | Sambalpur | Jodhpur | Hubli | Panchkula | Faridabad | Amravati | Ayodhya | Badlapur | Dehradun | Parbhani | Ujjain | Udaipur | Tiruchirappalli | Srinagar | Shimla | Secunderabad | Ratnagiri | Pandharpur | Ananthapuram | Buldhana | Hadapsar | Baramati | Chittoor | Darjeeling | Dhule | Fatehpur | Gandhinagar | Haridwar | Gorakhpur | Jhansi | Kanchipuram | Kartarpur | Kurukshetra | Pondicherry | Prayagraj | Bharuch | Bhusawal | Bathinda | Pathankot | Nandurbar | Niphad | Kolar | Ambala | Kota | Pendurthi | Jabalpur | Palwal | Bhilai | Bhiwani | Bilaspur | Patna | Rohtak | Phagwara | Malegaon | Vijayawada | Bikaner | Chiplun | Darbhanga | Roorkee | Bhor | Rajahmundry | Margao | Alwar | Dhanbad | Bulandshahr | Aluva | Mulshi | Davanagere | Kapurthala | Anantapur | Loni | Latur | Gondia | Chhindwara | Chandrapur | Dharmapuri-TN | Faridkot | Dharwad | Daund | Chaksu | Bareilly | Kakinada | Haldwani | Doddaballapur | Dindori-MH | Bagru | Kudus | Kozhikode | Gurdaspur | Bokaro | Berhampur | Batala | Barrackpore | Ramgarh | Meerut | Bassi | Dera Bassi | Howrah | Karjat Raigarh | Thiruvananthapuram | Bheemunipatnam | Ambegoan | Allahabad | Aligarh | Alappuzha | Tirupathi | Thoppumpady | Srikakulam | Siliguri | Rourkela | Mirzapur | Gadag | Bellary | Tumkur | Sonipat | Hoshangabad | Junnar | Jalna | Hisar | Karnal | Kottayam | Muzzafarnagar | Ramnagara | Thrissur | Bahadurgarh | Balasore | Baraut | Dhar | Ernakulam | Gadhinglaj | Chikodi | Vaniyambadi | Kamothe |