Home » Instant Medical Loan In Bengaluru: How Can It Help You?

With medical emergencies and conditions becoming more common, families in Bengaluru have to face the daunting prospect of finding the right financial help for medical treatment in Bengaluru. Due to rising medical expenses and a lack of funding, this can be challenging.

The financial strain that comes with receiving medical care can have a detrimental impact on the patient’s health. Stress hormones are released by the body when a person is worried about money, and these hormones can cause a variety of physical and mental health issues, including depression, anxiety, and difficulty sleeping. Also, financial stress can make your immune system less effective, which makes you more likely to get sick.

In order to effectively manage their medical conditions, people in Bengaluru must have access to the best financial assistance. Thankfully, those who require a medical loan in Bengaluru have a variety of options. Families can make sure that their loved ones get the best care when they need it by having access to the appropriate financial support.

People who need financial assistance with paying for medical expenses can use a loan for medical treatment. They are typically offered by lenders to those who require medical care but are unable to pay for it in full. Medical loans can be used to pay for a variety of medical treatments and services, including hospital bills, doctor visits, medications, and even medical supplies. It is not difficult to apply for them.

Medical loans can assist families who are struggling financially but require medical care for their loved ones. By making medical loans available, families can guarantee that their loved ones receive the care they require without worrying about the expense. By doing this, they can maintain their health and wellbeing and help families maintain their financial stability. Also, medical loans can help people with long-term illnesses pay for their care and get the treatments they need.

Access to Medical Care

Even if they lack the money to pay for it up front, medical loans can give them access to care. People in Bengaluru who might not be able to afford pricey treatments or medications can benefit from this.

Financial Security

By supplying families with the money they require to pay for medical care, medical loans can help them maintain their financial stability. They can have peace of mind and preserve their health and well-being thanks to this.

Management of Chronic Conditions

People with chronic illnesses can manage their care with the use of medical loans, which enable them to access the therapies they require. Those in Bengaluru who have chronic diseases may benefit from an improvement in their quality of life as a result of this.

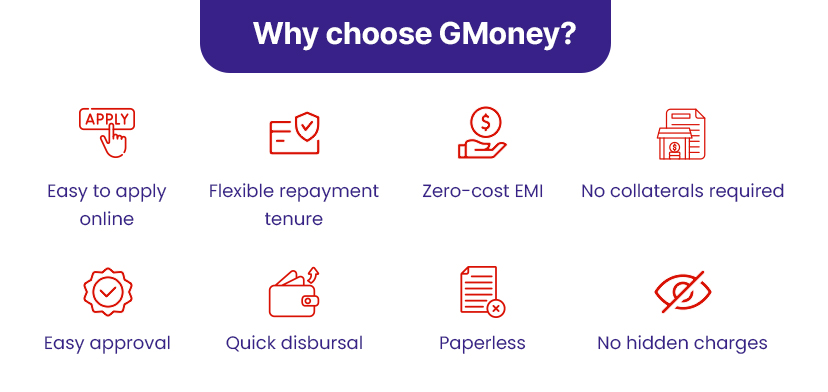

You can get a range of medical loan choices from GMoney that are catered to your needs. With zero interest rates, no-cost EMI and adaptable repayment options, their loans are accessible. Furthermore, they provide you with access to a network of healthcare professionals, allowing you to obtain the treatment you require quickly and easily.

Additionally, GMoney Finance is dedicated to providing top-notch customer service with a courteous, competent team. They are dedicated to assisting you in receiving medical treatment when you require it because they understand how critical it is. You may be certain that you are receiving the best financing possible with GMoney for your medical needs.

1) Are there interest rates on medical loans?

Medical loans may be pricey, depending on the lender’s terms and circumstances. However, GMoney provides medical loans with flexible EMIs and no interest to help you get the best care.

2) Is obtaining a medical loan challenging?

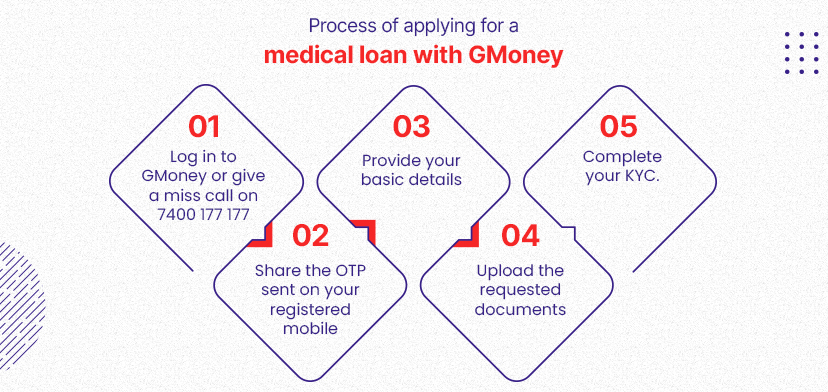

A medical loan from GMoney is easy to apply for, and anyone can do it online. This is different from many banks and financial institutions, which require a lot of paperwork and formalities.

3) Am I qualified for GMoney’s free EMI?

Anyone who lives in India and is between the ages of 21 and 58 is qualified for free EMI with GMoney.

4) Are there any processing fees associated with GMoney’s no-cost EMI?

GMoney doesn’t charge any processing fees. You can apply for a loan online quickly and for free.

For people in Bengaluru seeking medical loans to treat their chronic ailments, GMoney is a great option. GMoney is a fantastic partner for those who need therapies to improve their quality of life because of its cheap interest rates, flexible payment options, quick access to medical professionals, and first-rate customer support.

Disclaimer: THIS WEBSITE DOES NOT PROVIDE MEDICAL ADVICE.

Follow us

Reach us

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Quick Links

Bengaluru

GMoney Technologies Pvt. Ltd.

Oyo Work Spaces, Umiya Emporium,

Opposite Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka 560029

Ph : +91 89717 34815

Delhi

GMoney Technologies Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Next to jhandewalan metro station

gate no. 2 Barakhambha Road,

New Delhi, Delhi 110001

Ph : +91 97116 26832

Pune

GMoney Technologies Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Off, Airport Rd,

opposite Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra 411006

Ph : +91 84250 28758

Chandigarh

GMoney Technologies Pvt. Ltd.

SCO no. 292,

First Floor, Sector 35D,

Chandigarh

Ph : +91 84279 82012

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur – 302019

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad – 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) – 500081

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari, Tirumurthy Nagar, Nungambakkam, Chennai, Tamil

Nadu – 600 034

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Bengaluru

GMoney Pvt. Ltd.

Oyo Work Spaces,

Umiya Emporium,

Opp. Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka - 560029

Ph : +91 72089 60444

Pune

GMoney Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Airport Rd,

Opp. Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra - 411006

Ph : +91 72089 60444

Delhi

GMoney Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Gate no. 2 Barakhambha Road,

New Delhi, Delhi - 110001

Ph :

+91 72089 60444

Chandigarh

GMoney Pvt. Ltd.

SCO No. 292,

First Floor, Sector 35D,

Chandigarh - 160022

Ph : +91 72089 60444

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad - 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) - 500081

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur - 302019

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari,

Tirumurthy Nagar,Nungambakkam, Chennai,

Tamil

Nadu - 600 034

Pune | Mumbai | New Delhi | Kolkata | Chennai | Navi Mumbai| Bengaluru | Ahmedabad | Nagpur | Hyderabad | Jaipur | Lucknow | Bhopal | Bhubaneswar | Nashik | Indore | Ghaziabad | Kanpur | Amritsar | Vasai | Noida | Gurugram | Chandigarh | Ranchi | Cuttack | Thane | Kalyan | Jalandhar | Kolhapur | Visakhapatnam | Chakan| Greater Noida | Wagholi | Raipur | Panvel | Belgaum | Mohali | Bhiwandi | Talegaon | Coimbatore | Palghar | Mumbra | Sangli | Surat | Durgapur | Ludhiana | Kochi | Agra | Ahmednagar | Ajmer | Akola | Aurangabad | Baroda | Beed | Rewari | Patiala | Vellore | Ranjangaon | Nanded | Nellore | Panipat | Panjim | Madurai | Mysore | Mangalore | Korba | Mathura | Kalaburagi | Jalgaon | Kharar | Guwahati | Kollam | Jamshedpur | Gwalior | Saswad | Solapur | Varanasi | Salem | Sambalpur | Jodhpur | Hubli | Panchkula | Faridabad | Amravati | Ayodhya | Badlapur | Dehradun | Parbhani | Ujjain | Udaipur | Tiruchirappalli | Srinagar | Shimla | Secunderabad | Ratnagiri | Pandharpur | Ananthapuram | Buldhana | Hadapsar | Baramati | Chittoor | Darjeeling | Dhule | Fatehpur | Gandhinagar | Haridwar | Gorakhpur | Jhansi | Kanchipuram | Kartarpur | Kurukshetra | Pondicherry | Prayagraj | Bharuch | Bhusawal | Bathinda | Pathankot | Nandurbar | Niphad | Kolar | Ambala | Kota | Pendurthi | Jabalpur | Palwal | Bhilai | Bhiwani | Bilaspur | Patna | Rohtak | Phagwara | Malegaon | Vijayawada | Bikaner | Chiplun | Darbhanga | Roorkee | Bhor | Rajahmundry | Margao | Alwar | Dhanbad | Bulandshahr | Aluva | Mulshi | Davanagere | Kapurthala | Anantapur | Loni | Latur | Gondia | Chhindwara | Chandrapur | Dharmapuri-TN | Faridkot | Dharwad | Daund | Chaksu | Bareilly | Kakinada | Haldwani | Doddaballapur | Dindori-MH | Bagru | Kudus | Kozhikode | Gurdaspur | Bokaro | Berhampur | Batala | Barrackpore | Ramgarh | Meerut | Bassi | Dera Bassi | Howrah | Karjat Raigarh | Thiruvananthapuram | Bheemunipatnam | Ambegoan | Allahabad | Aligarh | Alappuzha | Tirupathi | Thoppumpady | Srikakulam | Siliguri | Rourkela | Mirzapur | Gadag | Bellary | Tumkur | Sonipat | Hoshangabad | Junnar | Jalna | Hisar | Karnal | Kottayam | Muzzafarnagar | Ramnagara | Thrissur | Bahadurgarh | Balasore | Baraut | Dhar | Ernakulam | Gadhinglaj | Chikodi | Vaniyambadi | Kamothe |