Home » Medical Loan In Bengaluru – GMoney Medical Loan

It can be challenging to manage the stress and costs associated with a medical emergency. It can be quite difficult for those who lack the financial resources to cover these medical expenditures. The price of medical treatment is increasing, and it sometimes seems insurmountable. The financial strain is further exacerbated by the fact that many people must take time from work to respond to their medical demands.

A medical loan in Bengaluru can be a big assistance in relieving financial pressure so people can focus on getting the healthcare they require without stressing about the high costs. These loans can be used to pay for several medical expenses, including doctor visits, treatments, hospital stays, and procedures.

A medical loan is a type of finance that aids in defraying the price of treatments, operations, and other healthcare services. In essence, it’s a loan used to pay for medical treatments’ associated costs.

Banks and other lending organisations frequently provide some financial help for medical treatment in Bengaluru, which can be used for everything from paying for long-term therapies to covering the cost of medical diagnostics. They can also be used to pay for the price of medical supplies or equipment required for a particular surgery or ailment.

A medical loan may be necessary in a variety of situations, including:

Keep in mind that a loan for medical treatment can be an excellent source of financial assistance in the event of a medical emergency or in the event that you need to afford pricey treatments or operations that your insurance policy might not cover. People who are looking for a way to fund their medical expenses should seriously consider applying for a GMoney fund.

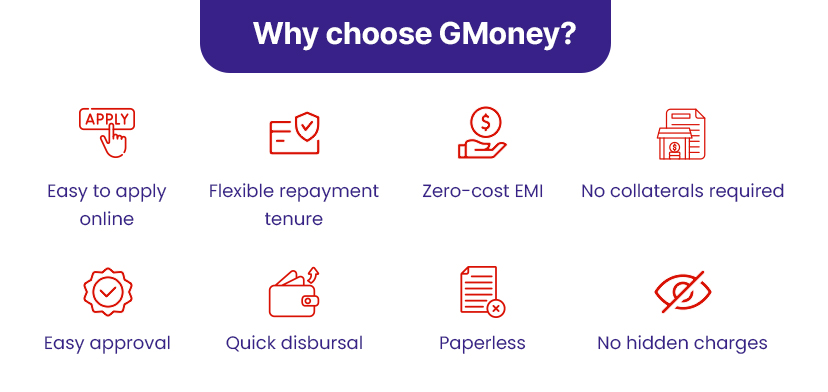

GMoney Finance understands that medical emergencies are stressful and expensive. We aim to give Bengaluru consumers fast and easy medical loans.

Our medical loans give emergency financial support. They are unsecured and have variable payback arrangements. Our no-cost EMI choices assist borrowers manage their loan payments.

We keep our application procedure simple and paperless. This allows folks in need of financial aid to get funding promptly.

Our medical loans offer flexibility, simplicity of access, low interest rates, and individualised customer support to help clients manage the loan procedure. We are committed to providing our clients with the financial resources they need in a medical emergency.

1) How can I apply for a medical loan?

Through GMoney Finance, a medical loan application can be submitted. They provide easy and quick options for medical financing.

2) What documents do I need to submit with my application for a medical loan?

When you apply for a medical loan with GMoney Finance, you usually have to show proof of who you are and how much money you make. Additionally, you must include details on the medical procedure you wish to fund.

3) What requirements must one satisfy to be eligible for a medical loan?

To get a medical loan from GMoney Finance, you usually need to be at least 18 years old, have a steady source of income, and have good credit.

Disclaimer: THIS WEBSITE DOES NOT PROVIDE MEDICAL ADVICE.

Follow us

Reach us

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Quick Links

Bengaluru

GMoney Technologies Pvt. Ltd.

Oyo Work Spaces, Umiya Emporium,

Opposite Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka 560029

Ph : +91 89717 34815

Delhi

GMoney Technologies Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Next to jhandewalan metro station

gate no. 2 Barakhambha Road,

New Delhi, Delhi 110001

Ph : +91 97116 26832

Pune

GMoney Technologies Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Off, Airport Rd,

opposite Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra 411006

Ph : +91 84250 28758

Chandigarh

GMoney Technologies Pvt. Ltd.

SCO no. 292,

First Floor, Sector 35D,

Chandigarh

Ph : +91 84279 82012

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur – 302019

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad – 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) – 500081

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari, Tirumurthy Nagar, Nungambakkam, Chennai, Tamil

Nadu – 600 034

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Bengaluru

GMoney Pvt. Ltd.

Oyo Work Spaces,

Umiya Emporium,

Opp. Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka - 560029

Ph : +91 72089 60444

Pune

GMoney Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Airport Rd,

Opp. Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra - 411006

Ph : +91 72089 60444

Delhi

GMoney Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Gate no. 2 Barakhambha Road,

New Delhi, Delhi - 110001

Ph :

+91 72089 60444

Chandigarh

GMoney Pvt. Ltd.

SCO No. 292,

First Floor, Sector 35D,

Chandigarh - 160022

Ph : +91 72089 60444

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad - 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) - 500081

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur - 302019

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari,

Tirumurthy Nagar,Nungambakkam, Chennai,

Tamil

Nadu - 600 034

Pune | Mumbai | New Delhi | Kolkata | Chennai | Navi Mumbai| Bengaluru | Ahmedabad | Nagpur | Hyderabad | Jaipur | Lucknow | Bhopal | Bhubaneswar | Nashik | Indore | Ghaziabad | Kanpur | Amritsar | Vasai | Noida | Gurugram | Chandigarh | Ranchi | Cuttack | Thane | Kalyan | Jalandhar | Kolhapur | Visakhapatnam | Chakan| Greater Noida | Wagholi | Raipur | Panvel | Belgaum | Mohali | Bhiwandi | Talegaon | Coimbatore | Palghar | Mumbra | Sangli | Surat | Durgapur | Ludhiana | Kochi | Agra | Ahmednagar | Ajmer | Akola | Aurangabad | Baroda | Beed | Rewari | Patiala | Vellore | Ranjangaon | Nanded | Nellore | Panipat | Panjim | Madurai | Mysore | Mangalore | Korba | Mathura | Kalaburagi | Jalgaon | Kharar | Guwahati | Kollam | Jamshedpur | Gwalior | Saswad | Solapur | Varanasi | Salem | Sambalpur | Jodhpur | Hubli | Panchkula | Faridabad | Amravati | Ayodhya | Badlapur | Dehradun | Parbhani | Ujjain | Udaipur | Tiruchirappalli | Srinagar | Shimla | Secunderabad | Ratnagiri | Pandharpur | Ananthapuram | Buldhana | Hadapsar | Baramati | Chittoor | Darjeeling | Dhule | Fatehpur | Gandhinagar | Haridwar | Gorakhpur | Jhansi | Kanchipuram | Kartarpur | Kurukshetra | Pondicherry | Prayagraj | Bharuch | Bhusawal | Bathinda | Pathankot | Nandurbar | Niphad | Kolar | Ambala | Kota | Pendurthi | Jabalpur | Palwal | Bhilai | Bhiwani | Bilaspur | Patna | Rohtak | Phagwara | Malegaon | Vijayawada | Bikaner | Chiplun | Darbhanga | Roorkee | Bhor | Rajahmundry | Margao | Alwar | Dhanbad | Bulandshahr | Aluva | Mulshi | Davanagere | Kapurthala | Anantapur | Loni | Latur | Gondia | Chhindwara | Chandrapur | Dharmapuri-TN | Faridkot | Dharwad | Daund | Chaksu | Bareilly | Kakinada | Haldwani | Doddaballapur | Dindori-MH | Bagru | Kudus | Kozhikode | Gurdaspur | Bokaro | Berhampur | Batala | Barrackpore | Ramgarh | Meerut | Bassi | Dera Bassi | Howrah | Karjat Raigarh | Thiruvananthapuram | Bheemunipatnam | Ambegoan | Allahabad | Aligarh | Alappuzha | Tirupathi | Thoppumpady | Srikakulam | Siliguri | Rourkela | Mirzapur | Gadag | Bellary | Tumkur | Sonipat | Hoshangabad | Junnar | Jalna | Hisar | Karnal | Kottayam | Muzzafarnagar | Ramnagara | Thrissur | Bahadurgarh | Balasore | Baraut | Dhar | Ernakulam | Gadhinglaj | Chikodi | Vaniyambadi | Kamothe |