Home » Medical Loans In Noida: How To Pay For Unexpected Medical Expenses

Medical emergencies can have catastrophic effects, especially in difficult financial times. The cost might be prohibitive, and the financial strain can be overwhelming. A medical emergency can also take a tremendous emotional and mental toll, leaving the person experiencing it feeling helpless.

No one should face the financial burden of a medical emergency alone. Unexpected medical costs can be stressful and challenging, especially during poor economic times.

Getting a medical loan in Noida might be a good option if you have extensive hospital bills. Unexpected medical costs can be paid for with the help of a medical loan, which enables people to control their medical debt. People can feel secure knowing that they can pay their medical expenses with a medical loan and may even be able to avoid going into debt.

A medical loan is created to assist people in paying for their expenses. People who are dealing with expensive hospital bills or other medical expenses frequently use it. This loan can offer the resources needed to pay for unforeseen medical costs, enabling people to manage their medical debt. People can feel secure knowing they can pay medical expenses with a medical loan. Financial help for medical treatment in Noida can save people from suffering and can help them save their loved ones.

Medical loans can be used for several things, such as doctor visits, buying prescription drugs, paying for medical treatments, etc. Furthermore, many medical loans offer flexible repayment alternatives, letting borrowers select the one that fits their budget the most. This makes medical loans an excellent option for people who need to manage their medical debt responsibly.

Timely Medical Treatment

A medical loan enables prompt, adequate medical care. With the aid of a medical loan, you won’t have to wait for your money to build up to pay for required medical operations and treatments to pay for essential medical procedures and treatments. This is particularly beneficial in emergency cases where a delay in treatment may result in more severe health issues.

Access to Necessary Medical Procedures

Access to necessary medical procedures and treatments that your insurance may not cover is made possible through a loan for medical treatment. This can include the cost of operations, diagnostic procedures, and other medical costs. Thanks to a medical loan, you won’t have to stress about the cost of your care.

Paying for Expensive Medical Treatments

Only some people have the finances necessary to cover the cost of medical treatments out of pocket because they can be pretty pricey. With the help of a medical loan, people who need these treatments can get them for less money.

Paying for Planned and Unexpected Medical Expenses

Medical loans can cover both anticipated and unforeseen medical expenses. This can cover pre-planned procedures, diagnostic exams, post-treatment care, and any unexpected medical costs resulting from an illness or injury.

Covering Expenses Not Covered by Insurance

Insurance policies frequently have hefty deductibles, co-pays, and coverage limits. You can use a medical loan to cover costs your insurance won’t cover. This can include items like non-covered services from in-network doctors and hospitals, among other things.

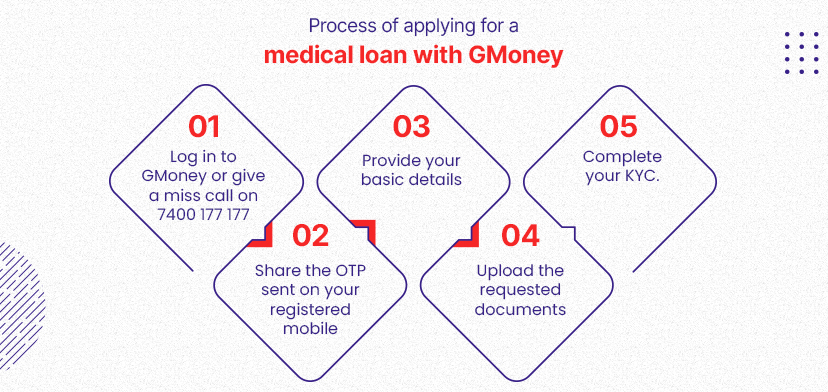

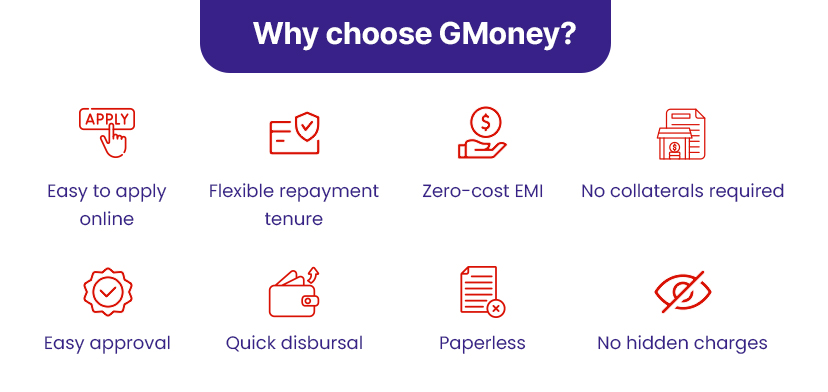

With no requirement to declare a condition, GMoney offers a quick and uncomplicated loan application process. In an emergency, you can quickly get authorised for a loan to pay for medical expenses. Paying medical costs and receiving care in affiliated hospitals is quick and straightforward with GMoney. Using GMoney for medical crises has many benefits, including rapid loan approval, no-cost EMI and access to premier hospitals.

Numerous medical expenses can be covered with a medical loan from GMoney Finance. Our loans can assist you in getting the care you require, regardless of whether you have a minor health ailment or a more significant problem. With our quick loan approval procedure, you can quickly acquire the required assistance.

1) Can I apply for a medical loan if I have a low credit score?

Yes, even if your credit score is low, you can still apply for a medical loan from GMoney; however, your loan amount may be affected.

2) How can I find out the status of my application for a medical loan?

By checking on your GMoney account or getting in touch with customer care, you may find out the progress of your application for a medical loan.

GMoney Finance provides a simple and helpful solution to medical debt. Our partners include some of the best hospitals in the world, and our loan application procedure is rapid, secure, and private. You can pay for the required medical care using GMoney without worrying about the cost.

Disclaimer: THIS WEBSITE DOES NOT PROVIDE MEDICAL ADVICE.

Follow us

Reach us

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Quick Links

Bengaluru

GMoney Technologies Pvt. Ltd.

Oyo Work Spaces, Umiya Emporium,

Opposite Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka 560029

Ph : +91 89717 34815

Delhi

GMoney Technologies Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Next to jhandewalan metro station

gate no. 2 Barakhambha Road,

New Delhi, Delhi 110001

Ph : +91 97116 26832

Pune

GMoney Technologies Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Off, Airport Rd,

opposite Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra 411006

Ph : +91 84250 28758

Chandigarh

GMoney Technologies Pvt. Ltd.

SCO no. 292,

First Floor, Sector 35D,

Chandigarh

Ph : +91 84279 82012

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur – 302019

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad – 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) – 500081

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari, Tirumurthy Nagar, Nungambakkam, Chennai, Tamil

Nadu – 600 034

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Bengaluru

GMoney Pvt. Ltd.

Oyo Work Spaces,

Umiya Emporium,

Opp. Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka - 560029

Ph : +91 72089 60444

Pune

GMoney Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Airport Rd,

Opp. Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra - 411006

Ph : +91 72089 60444

Delhi

GMoney Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Gate no. 2 Barakhambha Road,

New Delhi, Delhi - 110001

Ph :

+91 72089 60444

Chandigarh

GMoney Pvt. Ltd.

SCO No. 292,

First Floor, Sector 35D,

Chandigarh - 160022

Ph : +91 72089 60444

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad - 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) - 500081

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur - 302019

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari,

Tirumurthy Nagar,Nungambakkam, Chennai,

Tamil

Nadu - 600 034

Pune | Mumbai | New Delhi | Kolkata | Chennai | Navi Mumbai| Bengaluru | Ahmedabad | Nagpur | Hyderabad | Jaipur | Lucknow | Bhopal | Bhubaneswar | Nashik | Indore | Ghaziabad | Kanpur | Amritsar | Vasai | Noida | Gurugram | Chandigarh | Ranchi | Cuttack | Thane | Kalyan | Jalandhar | Kolhapur | Visakhapatnam | Chakan| Greater Noida | Wagholi | Raipur | Panvel | Belgaum | Mohali | Bhiwandi | Talegaon | Coimbatore | Palghar | Mumbra | Sangli | Surat | Durgapur | Ludhiana | Kochi | Agra | Ahmednagar | Ajmer | Akola | Aurangabad | Baroda | Beed | Rewari | Patiala | Vellore | Ranjangaon | Nanded | Nellore | Panipat | Panjim | Madurai | Mysore | Mangalore | Korba | Mathura | Kalaburagi | Jalgaon | Kharar | Guwahati | Kollam | Jamshedpur | Gwalior | Saswad | Solapur | Varanasi | Salem | Sambalpur | Jodhpur | Hubli | Panchkula | Faridabad | Amravati | Ayodhya | Badlapur | Dehradun | Parbhani | Ujjain | Udaipur | Tiruchirappalli | Srinagar | Shimla | Secunderabad | Ratnagiri | Pandharpur | Ananthapuram | Buldhana | Hadapsar | Baramati | Chittoor | Darjeeling | Dhule | Fatehpur | Gandhinagar | Haridwar | Gorakhpur | Jhansi | Kanchipuram | Kartarpur | Kurukshetra | Pondicherry | Prayagraj | Bharuch | Bhusawal | Bathinda | Pathankot | Nandurbar | Niphad | Kolar | Ambala | Kota | Pendurthi | Jabalpur | Palwal | Bhilai | Bhiwani | Bilaspur | Patna | Rohtak | Phagwara | Malegaon | Vijayawada | Bikaner | Chiplun | Darbhanga | Roorkee | Bhor | Rajahmundry | Margao | Alwar | Dhanbad | Bulandshahr | Aluva | Mulshi | Davanagere | Kapurthala | Anantapur | Loni | Latur | Gondia | Chhindwara | Chandrapur | Dharmapuri-TN | Faridkot | Dharwad | Daund | Chaksu | Bareilly | Kakinada | Haldwani | Doddaballapur | Dindori-MH | Bagru | Kudus | Kozhikode | Gurdaspur | Bokaro | Berhampur | Batala | Barrackpore | Ramgarh | Meerut | Bassi | Dera Bassi | Howrah | Karjat Raigarh | Thiruvananthapuram | Bheemunipatnam | Ambegoan | Allahabad | Aligarh | Alappuzha | Tirupathi | Thoppumpady | Srikakulam | Siliguri | Rourkela | Mirzapur | Gadag | Bellary | Tumkur | Sonipat | Hoshangabad | Junnar | Jalna | Hisar | Karnal | Kottayam | Muzzafarnagar | Ramnagara | Thrissur | Bahadurgarh | Balasore | Baraut | Dhar | Ernakulam | Gadhinglaj | Chikodi | Vaniyambadi | Kamothe |