Home » Instant Medical Loan In Chennai: How To Pay Expensive Medical Bills

A medical emergency can be a difficult and trying experience for any family. The costs incurred by such occurrences, whether it be an unexpected surgery or a protracted hospital stay, can be substantial and challenging to pay. Finding financial relief during a crisis can be intimidating and stressful.

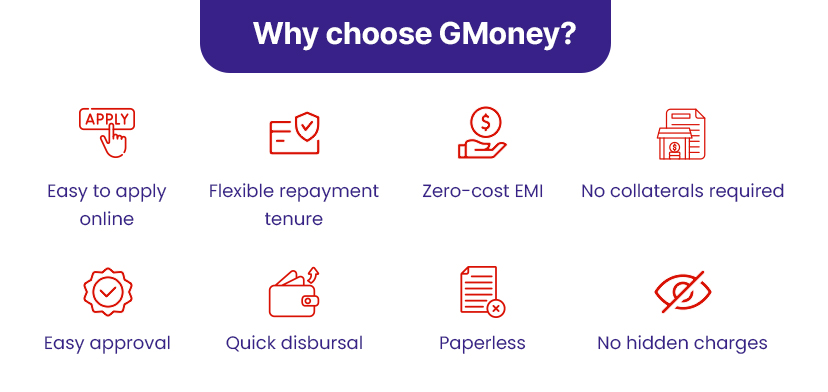

Fortunately, families can receive the money they require for free through EMI thanks to GMoney instant medical loan in Chennai. By easing the financial burden of medical emergencies, this loan enables families to concentrate on their loved ones’ recovery without worrying about the cost.

A medical loan is a type of financial aid given to people who need money for medical procedures or treatments. It offers a practical approach to raising the money needed for medical care, allowing families to put their loved ones’ health before the cost.

A loan for medical treatment can also be used to cover ongoing healthcare costs like prescriptions, doctor visits, and other expenses. People and their families can feel secure knowing they have the resources necessary to cover their medical expenses with an instant medical loan in Chennai.

No matter how urgent the need is for medical care, a medical loan can be obtained. For instance, it can pay for common medical costs like prescriptions, checkups with the doctor, lab work, and so forth. Additionally, it can be used to pay for expensive medical procedures like surgery and hospital stays. Medical loans can also be used to pay for more serious health issues, enabling people to get the care they need without having to worry about paying for it.

Following are a few of the many conditions and procedures for which you can get financial help for medical treatment in Chennai:

Unexpected expenses may arise from a trip to the emergency room, particularly if it necessitates a hospital stay. These expenses might cover the price of the ER visit, any necessary follow-up care, diagnostic tests, and medications. A medical loan may help with some of these expenses, allowing the patient to focus on their recovery rather than worrying about money.

Unexpected illnesses can result in expensive medical expenses, including the price of prescription drugs, diagnostic procedures, and doctor visits. For instance, a person might suddenly become afflicted with a serious illness like appendicitis or a heart attack that necessitates surgery and a hospital stay. A medical loan can give the patient the money they need to cover these costs, so they can get the care they need without worrying about how to pay for it.

Chronic illnesses like diabetes, heart disease, and cancer demand ongoing medical attention and can be very expensive. For instance, a person with diabetes might need to buy supplies like insulin, test strips, and other things frequently. Over time, a medical loan can help pay for these expenses, ensuring that the person has the money they need to take care of their condition and keep themselves healthy.

Organ transplants and cancer treatments, for example, can be very pricey medical procedures or treatments. For instance, a person who requires a heart transplant may incur expenses of at least ₹5,00,000. These expenses may be covered by a medical loan, enabling the patient to get the specialised care they require without having to worry about the cost.

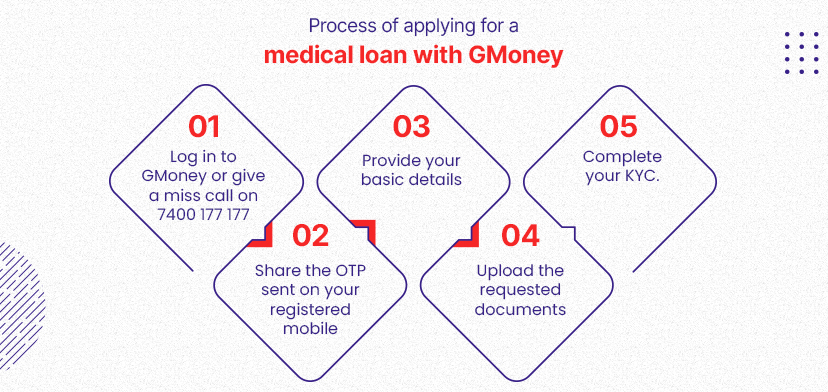

The GMoney loan application procedure is easy to understand and does not require the disclosure of a medical condition. In an emergency, getting a loan to cover medical costs is simple. It’s quick and simple to pay medical bills with GMoney Finance and receive treatment in affiliated hospitals. There are many benefits to using GMoney for medical emergencies, including no-cost EMI payments, access to top hospitals, and instant loan approval.

GMoney Finance’s medical loans can help with a range of medical expenses. Our loans can help you get the treatment you require, regardless of whether you have a minor illness or a more serious problem. With our quick loan approval process, you can quickly get the assistance you require.

1) Can I apply for the loan if I am self-employed?

GMoney does indeed accept applications from both salaried and independent contractors.

2) Can I apply for a medical loan if I am retired?

Yes, people of all ages are welcome to apply to GMoney.

3) Can I use the loan for pre-existing medical conditions?

You can use the loan to pay for any medical expenses, yes.

4) Is there any pre-payment penalty for paying off the loan early?

No penalties are assessed for early repayment with GMoney.

Anyone in need of an emergency medical loan should consider GMoney Finance. It can help you receive the care you need without having to worry about the cost thanks to quick loan approval, free EMI payments, and access to top hospitals. GMoney Finance offers the financial support you require when you need it, making it a dependable and practical way to pay for medical expenses.

Disclaimer: THIS WEBSITE DOES NOT PROVIDE MEDICAL ADVICE.

Follow us

Reach us

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Quick Links

Bengaluru

GMoney Technologies Pvt. Ltd.

Oyo Work Spaces, Umiya Emporium,

Opposite Forum Mall, Hosur Rd,

Koramangala, Bengaluru,

Karnataka 560029

Ph : +91 89717 34815

Delhi

GMoney Technologies Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Next to jhandewalan metro station

gate no. 2 Barakhambha Road,

New Delhi, Delhi 110001

Ph : +91 97116 26832

Pune

GMoney Technologies Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Off, Airport Rd,

opposite Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra 411006

Ph : +91 84250 28758

Chandigarh

GMoney Technologies Pvt. Ltd.

SCO no. 292,

First Floor, Sector 35D,

Chandigarh

Ph : +91 84279 82012

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur – 302019

Ahmedabad

GMoney Pvt. Ltd.

22nd Floor, B Block,

Westgate By True Value,

Nr. YMCA Club, SG Highway,

Ahmedabad – 380051

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) – 500081

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari, Tirumurthy Nagar, Nungambakkam, Chennai, Tamil

Nadu – 600 034

Mumbai HO

GMoney Pvt. Ltd.

315, 215 Atrium,

Next to Courtyard by Marriott,,

A.K. Road, Andheri East,

Mumbai - 400093

Ph : +91 86570 00105, +91 72089 60444

Bengaluru

GMoney Pvt. Ltd.

3rd floor, Ranka Junction,

AH45, Krishna Reddy Industrial Estate,

Dooravani Nagar,

Bengaluru Karnataka - 560016

Ph : +91 72089 60444

Pune

GMoney Pvt. Ltd.

91 Spring Board, Sky Loft,

Creaticity Mall, Airport Rd,

Opp. Golf Course, Shastrinagar,

Yerawada, Pune,

Maharashtra - 411006

Ph : +91 72089 60444

Delhi

GMoney Pvt. Ltd.

Berry Co Works, 1E/3,

Jhandewalan extension,

Gate no. 2 Barakhambha Road,

New Delhi, Delhi - 110001

Ph :

+91 72089 60444

Chandigarh

GMoney Pvt. Ltd.

SCO No. 292,

First Floor, Sector 35D,

Chandigarh - 160022

Ph : +91 72089 60444

Hyderabad

GMoney Pvt. Ltd.

Dwaraka Pride,

Plot no. 4/1, Survey No. 64,

Huda Techno Enclave, Madhapur,

Hyderabad (Telangana) - 500081

Jaipur

GMoney Pvt. Ltd.

CODESKK Civil Tower,121 122,

Pandit TN Mishra Marg,

Santhosh Nagar, Nirman Nagar,

Jaipur - 302019

Chennai

GMoney Pvt. Ltd.

DBS Business Center, 31A,

Cathedral Garden Rd, Badrikari,

Tirumurthy Nagar,Nungambakkam, Chennai,

Tamil

Nadu - 600 034

Pune | Mumbai | New Delhi | Kolkata | Chennai | Navi Mumbai| Bengaluru | Ahmedabad | Nagpur | Hyderabad | Jaipur | Lucknow | Bhopal | Bhubaneswar | Nashik | Indore | Ghaziabad | Kanpur | Amritsar | Vasai | Noida | Gurugram | Chandigarh | Ranchi | Cuttack | Thane | Kalyan | Jalandhar | Kolhapur | Visakhapatnam | Chakan| Greater Noida | Wagholi | Raipur | Panvel | Belgaum | Mohali | Bhiwandi | Talegaon | Coimbatore | Palghar | Mumbra | Sangli | Surat | Durgapur | Ludhiana | Kochi | Agra | Ahmednagar | Ajmer | Akola | Aurangabad | Baroda | Beed | Rewari | Patiala | Vellore | Ranjangaon | Nanded | Nellore | Panipat | Panjim | Madurai | Mysore | Mangalore | Korba | Mathura | Kalaburagi | Jalgaon | Kharar | Guwahati | Kollam | Jamshedpur | Gwalior | Saswad | Solapur | Varanasi | Salem | Sambalpur | Jodhpur | Hubli | Panchkula | Faridabad | Amravati | Ayodhya | Badlapur | Dehradun | Parbhani | Ujjain | Udaipur | Tiruchirappalli | Srinagar | Shimla | Secunderabad | Ratnagiri | Pandharpur | Ananthapuram | Buldhana | Hadapsar | Baramati | Chittoor | Darjeeling | Dhule | Fatehpur | Gandhinagar | Haridwar | Gorakhpur | Jhansi | Kanchipuram | Kartarpur | Kurukshetra | Pondicherry | Prayagraj | Bharuch | Bhusawal | Bathinda | Pathankot | Nandurbar | Niphad | Kolar | Ambala | Kota | Pendurthi | Jabalpur | Palwal | Bhilai | Bhiwani | Bilaspur | Patna | Rohtak | Phagwara | Malegaon | Vijayawada | Bikaner | Chiplun | Darbhanga | Roorkee | Bhor | Rajahmundry | Margao | Alwar | Dhanbad | Bulandshahr | Aluva | Mulshi | Davanagere | Kapurthala | Anantapur | Loni | Latur | Gondia | Chhindwara | Chandrapur | Dharmapuri-TN | Faridkot | Dharwad | Daund | Chaksu | Bareilly | Kakinada | Haldwani | Doddaballapur | Dindori-MH | Bagru | Kudus | Kozhikode | Gurdaspur | Bokaro | Berhampur | Batala | Barrackpore | Ramgarh | Meerut | Bassi | Dera Bassi | Howrah | Karjat Raigarh | Thiruvananthapuram | Bheemunipatnam | Ambegoan | Allahabad | Aligarh | Alappuzha | Tirupathi | Thoppumpady | Srikakulam | Siliguri | Rourkela | Mirzapur | Gadag | Bellary | Tumkur | Sonipat | Hoshangabad | Junnar | Jalna | Hisar | Karnal | Kottayam | Muzzafarnagar | Ramnagara | Thrissur | Bahadurgarh | Balasore | Baraut | Dhar | Ernakulam | Gadhinglaj | Chikodi | Vaniyambadi | Kamothe |